Retiring or Separating from the University

We will be sorry to see you go, but plans change, and we wish you well! Listed below are some important items and information to think about when leaving the University.

Leaving CSUB

Review and complete the Separation Clearance Form and Instructions.

Work closely with your department or college office to ensure all items are cleared in a timely manner.

The Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985 was enacted into law on April 7, 1986, and applies to the California State University through the Public Health Service Act. Generally, COBRA permits covered individuals who lose coverage under the plan(s) as a result of certain “qualifying events” to elect to continue their coverage under the plan(s) for a prescribed period of time on a self-pay basis, for up to 18, 29 or 36 months, depending on the qualifying event.

If as an active employee, you have been covered by a health plan, your benefits coverage will likely continue through the month of separation or loss of benefits eligibility and the month following. A COBRA Qualifying Event Election Notice will be sent to your mailing address upon your separation or loss of benefits eligibility, the date your benefits will end will be included. This notice contains information regarding continuing coverage through COBRA, COBRA rates, and the election form you will need to complete should you decide to elect COBRA.

If you have contributions from your pay taken for retirement, you have a couple of options. An employee with CalPERS funds on file is able to leave their funds with CalPERS or request a refund or roll the funds over to another retirement account. Learn more about leaving CalPERS.

For CSU Supplemental Retirement Plan 403(b), review Transactions Flowchart or contact Fidelity NetBenefits for more information.

Changes to Savings Plus Program (SPP) 401(k) and 457 are handled between employees and Savings Plus Program (CalHR). Visit Savings Plus for more information.

Employees who are (or were) in the Part-Time, Seasonal, and Temporary Retirement Program (PST) can find out about a refund or rollover of the funds by visiting Savings Plus.

VACATION BALANCE

Your accrued vacation balance will be paid out in a lump sum with your final pay. In lieu of a payout, you have the option to request deferral of the lump sum vacation payout to your current 401(k), 457 or 403(b) account(s). You are eligible to transfer up to the maximum contribution limit to each account, minus the amount you have already contributed to the plan.

If your separation date is on or after November 1, you have the option to make the transfer for the current and following tax year, up to the maximum annual contribution limits.

Individuals considering this option should contact the Office of Human Resources prior to their separation. Generally, this option must be exercised at least 30 days prior to separation from the University.

SICK LEAVE BALANCE

Your accrued sick leave balance will not be paid out. If you are leaving to work for another California State University campus, or other state agency, you may be able to transfer all or part of your accrued sick leave. If you are retiring, the accrued sick leave balance will be reported to CalPERS for conversion to service credit. Please contact the Office of Human Resources for additional information.

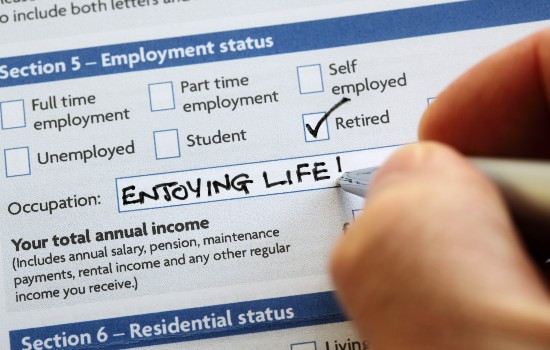

Retiring

Congratulations on your decision to retire and thank you for your years of service! We hope that you will find the following information helpful.

Employees are eligible to retire and receive a pension when they have 5 years of CalPERS-credited service and when they reach the minimum retirement age of 50, or for those hired after 1/1/13, age 52.

You will be separating from the CSU and retiring from CalPERS. As a separating employee, you will need to go through the separation process. For more information about the separation process and your responsibilities, go to the Separating Employee Responsibility Section or contact Human Resources at hr@csub.edu or by calling (661) 654-2266.

You may wish to review the Retirement Planning Checklist. Individual appointments may be made with a CalPERS retirement specialist by calling 888-225-7377. Although an appointment may be made, it is not required.

The earliest possible retirement date is the day following an employee’s last day

on pay status. Retirement may be effective any day of the week; if an employee separates

on Friday, retirement may be effective on Saturday. If an academic year employee receives their paychecks spread out over twelve months

and retires immediately following the end of the academic year (6/1), instead of when

their paychecks normally run out (9/1), they will start collecting their retirement

pay earlier and will receive the pay earned during the academic year as a settlement

check sometime in June. Employees should determine which date is more advantageous. For some, it might be

better to remain on payroll through the summer months due to a various factors such

as additional service credit or attaining a birthday quarter. Other employees will

benefit more from collecting retirement pay during the summer. If an employee is planning to retire at the end of the year or at the beginning of

the next year, they should consider the cost of living (COLA) adjustment. The COLA

is applied to the retirement allowance on May 1 of the second calendar year following

retirement. For example: If your retirement date is... Then you become eligible for COLA on ... December 31, 2023 May 1, 2025 January 1, 2024 May 1, 2026 CSU post-retirement medical and dental benefits are available to employees (and their

eligible dependents) who retire within 120 days of separation from employment. If

you retire less than 30 days after your separation, your medical coverage will continue

automatically. Contact the HR office if retiring between 30 and 120 days of separation. You will be eligible for a CalPERS-administered health plan as a retiree if you meet

all the following criteria: The cost of medical coverage will depend on several factors. If you are under the

age of 65, you will continue on the same plan that you had as an active employee and

you will pay the same premium. If you are over 65 or your spouse is over 65, you will

work with the Social Security Administration for enrollment in Medicare and with CalPERS

to enroll in a Medicare supplement plan. PLEASE NOTE: All employees hired by the CSU and who become new CalPERS members on

or after July 1, 2018, are eligible for the CalPERS Retiree Medical Benefits and CSU

Retiree Dental Benefits after a 10-year vesting period. Faculty (Unit 3) employees

hired by the CSU and who become members of CalPERS on or after July 1, 2017, must

have 10 years of service credit with CalPERS to be eligible to enroll. If you are enrolled in the Enhanced DeltaCare HMO or Delta Dental plans, your coverage

as a retiree will change to the Basic level. Currently, the CSU pays the full cost

of the Basic level dental coverage for eligible retirees and their eligible dependents.

You also have the option to continue with the Enhanced dental coverage for a small

monthly cost. To compare the two plans, please review the Dental Plan Comparison (PDF) document. Retirees may enroll in the CSU Retiree Voluntary Vision Plan within 60 days of retirement.

The monthly premium is fully paid by the retiree and is deducted from their paycheck

(warrant) issued by CalPERS. You may also choose to enroll in the VSP Premier plan,

which allows for additional benefits, however the premium costs are slightly higher

than the VSP Basic plan. To compare the two plans, please review the VSP Page for CSU retirees. Information on the changes to your dental plan and enrolling in the vision plan will

be sent to you by the Office of Human Resources shortly after your retirement date. Your accrued vacation balance will be paid out in a lump sum with your final pay.

In lieu of a payout, you have the option to request deferral of the lump sum vacation

payout to your current 401(k), 457 or 403(b) account(s). You are eligible to transfer

up to the maximum contribution limit to each account, minus the amount you have already

contributed to the plan. If your separation date is on or after November 1, you have the option to make the

transfer for the current and following tax year, up to the maximum annual contribution

limits. Individuals considering this option should contact HR prior to separation. Generally,

this option must be exercised at least 30 days prior to separation from the University. If you are Medicare-eligible, receiving retirement health benefits, and not enrolled

in a CalPERS Medicare health benefits plan, you will need to enroll in a CalPERS Medicare

health benefits plan to continue your health coverage through the CalPERS Health Program. Continuing CalPERS Health Coverage After Age 65 A few months before you turn 65, CalPERS will send you notifications of the requirements

to continue your health coverage. The notifications request information about your

eligibility or ineligibility to enroll in Medicare. You must meet these requirements

to continue your CalPERS health coverage: Medicare Health Plan Availability CalPERS offers the following Medicare health plans: Kaiser Permanente Senior Advantage HMO Plan PERS Gold and PERS Platinum Medicare Supplement PPO Plans Includes enrollment in OptumRx Medicare Part D prescription drug plan Anthem Medicare Preferred PPO Plan UnitedHealthcare (UHC) Group Medicare Advantage PPO Plan Faculty members who are interested in the FERP program should contact the Office of Provost and Vice President Academic Affairs. Service retirement must begin concurrently with, or prior to, the beginning of the

campus academic year in which FERP participation will begin. The faculty member must

initiate the service retirement process no more than 90 days before retirement date.Retirement Timeline Process

Additional To-dos

(800-464-4000)

(877) 737-7776

(855) 251-8825

(888-867-5581)

- Employee Resources Home

- New Hire Resources

- Classification and Compensation

- Retiring or Separating from the University

- Total Compensation

- Disability and Lactation Accommodations

- Calendars

- Telecommuting

- Workers' Compensation

- Payroll

- Time and Attendance Reporting

- Employment and Salary Verification

- Cal Employee Connect

- MyHR

Contact Us

HR Hours:

Monday - Friday: 8:00 am - 5:00 pm

Office Location:

Administration 104

Mailing Address:

California State University, Bakersfield

9001 Stockdale Highway

Bakersfield, CA 93311-1099

Email: hr@csub.edu

Phone: (661) 654-2266

Fax: (661) 654-2299

HELP US IMPROVE THE HR WEBSITE BY ANSWERING THIS SHORT ONLINE SURVEY.

Find Us